If chocolate plays a role in your business, this is the time to stay alert.

One of our clients, aware of the strategic importance of chocolate in their market, partnered with A-INSIGHTS to get a real-time picture of what’s really happening in the global chocolate sector. Their Market Intelligence team wanted to act early, before the market shifted.

In this blog, we highlight some of the key outcomes of that analysis. You’ll find signals from grinding data, company earnings, and market shifts that can help you make better decisions, faster.

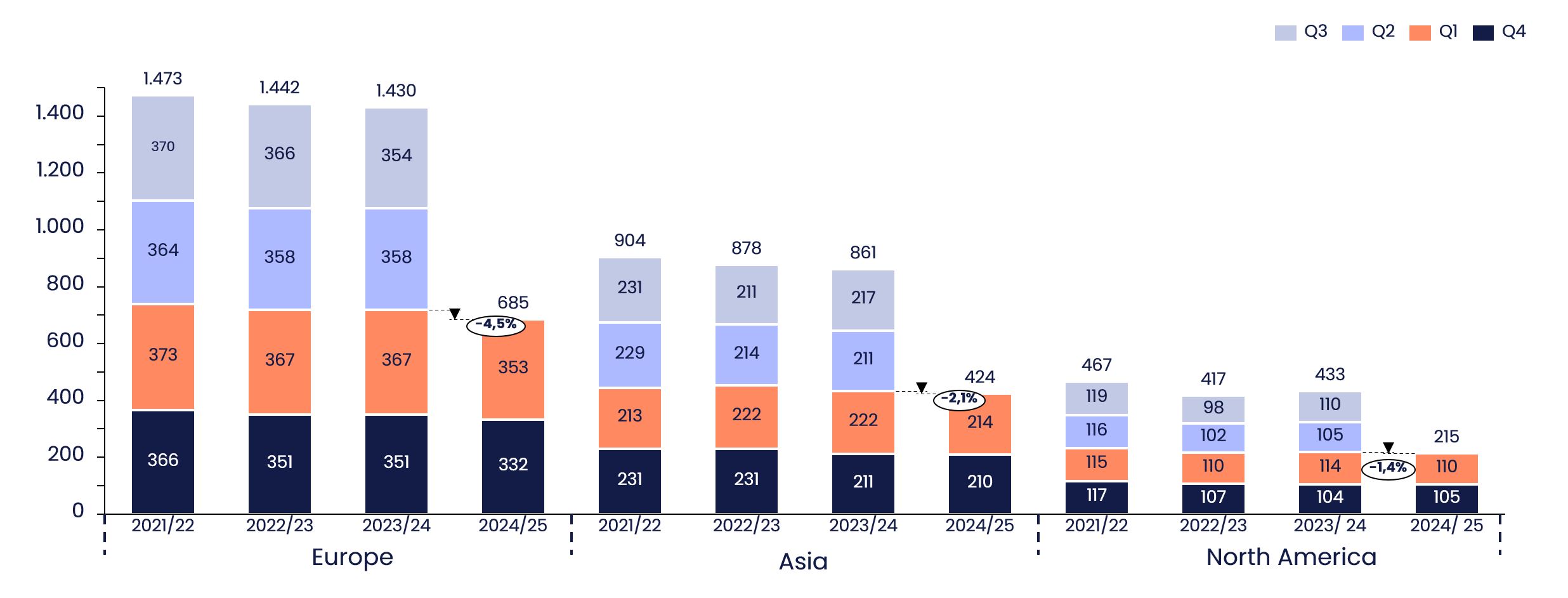

Cocoa processing data shows signs of weakening global demand

Data from cocoa associations reveals a decline in cocoa processing volumes across Europe, Asia, and North America in Q1 2025.

Earnings reports confirm the trend: revenue holds up, but volumes are falling

Earnings results from Nestlé, Mondelez, and Barry Callebaut underline a key message: volume is under pressure even as pricing props up revenue.

- Nestlé saw 8.9% growth in chocolate, led by pricing. However, volumes are under pressure in Europe and Asia.

- Mondelez reported 3.1% total growth, driven by a 6.6% pricing increase but offset by a 3.5% decline in volume.

- Barry Callebaut experienced a 0.8% decline in overall volume, marking the second consecutive quarterly drop.

Margins have taken a hit. Mondelez reported a 5.8 percentage point drop in gross margin, driven by elevated cocoa prices.

Consumers are pushing back against higher prices, especially in North America. This has led to demand slowdowns and company responses like reduced pack sizes, cocoa reformulation, and targeted pricing strategies.

.png)

Visualizing regional pressure on volume

Nestlé and Mondelez face headwinds in all major regions. Barry Callebaut also shows a downward trend, particularly in Europe and Asia.

Behind the drop: Rising costs and shifting lifestyles reshape chocolate consumption

Cocoa prices hit historic highs

- In February 2025, cocoa futures crossed $9,000 per ton amid crop shortfalls in Ghana and Ivory Coast.

- By December 2024, cocoa hit $12,000 per ton—a 300% rise from 2022 levels—due to climate-related failures and underinvestment.

Shrinkflation and product reformulation

- Cadbury, Nestlé, and Mars have reduced package sizes and adjusted cocoa content without cutting prices.

- Popular Easter chocolates were smaller in 2025, continuing this trend.

Health and lifestyle factors drive demand changes

- GLP-1 weight-loss drugs like Ozempic are prompting consumers to cut back on sugar-heavy snacks.

- UK snacking has dropped 15% since 2020 as habits shift with the return to office work.

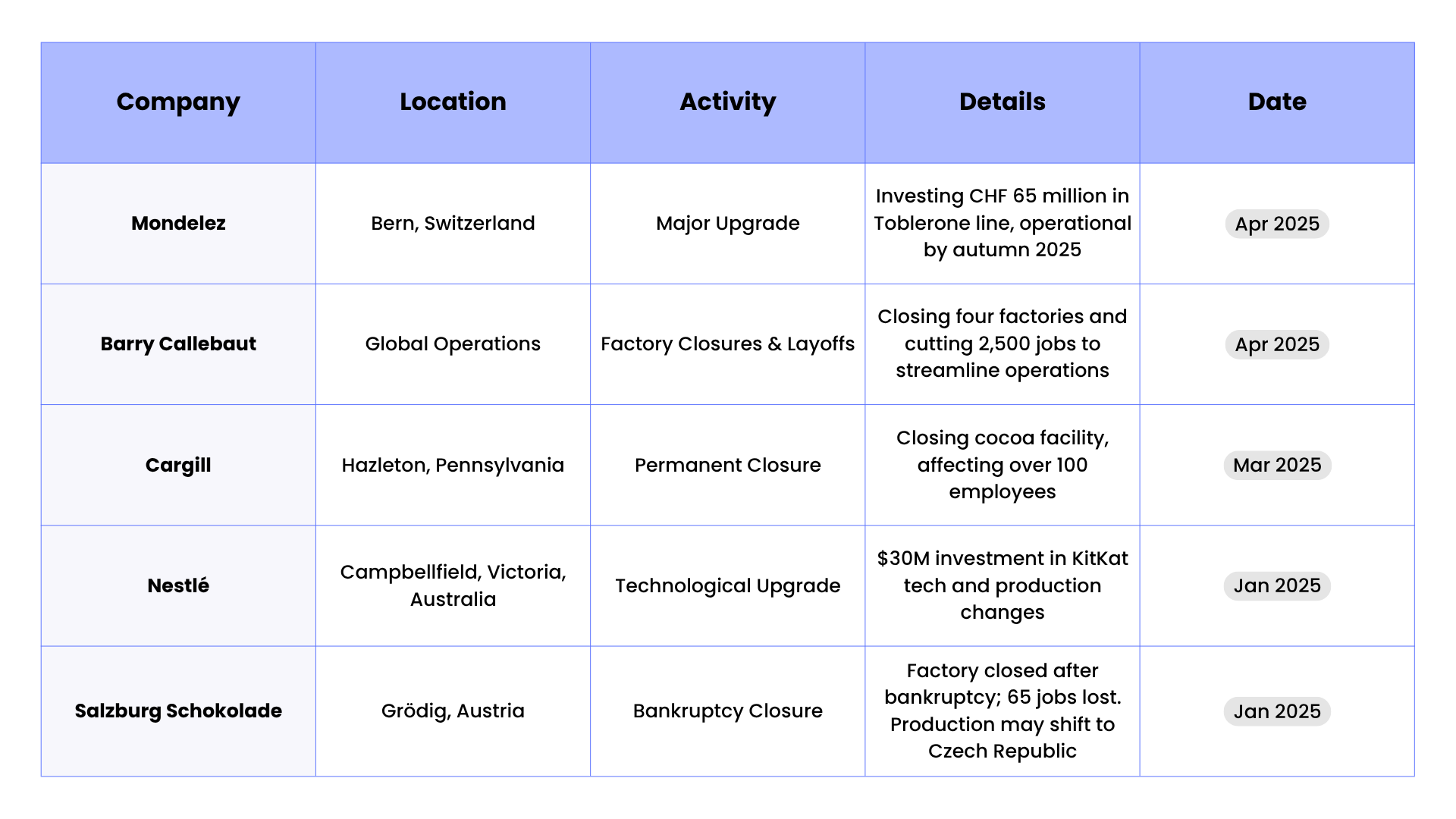

Factory closures and production cuts add further signs of strain

The first quarter of 2025 saw several large-scale changes in chocolate production.

How we deliver strategic insights that matter

This analysis began as a business request from one of our customers. They needed to quickly understand what was happening in the global chocolate sector and what that meant for them.

We handled the research, structured the findings, and delivered a clear and usable insight within just a few hours.

At A-INSIGHTS, we believe your team shouldn’t have to do everything themselves. We walk alongside you, lighting the way forward with reliable data and sharp analysis.

You bring the question. We do the work, so that you can act with clarity and confidence. This is how we turn uncertainty into insight.

Do you want to stay updates about these and other trends happening in the food industry? Subscribe to our newsletter!